Seven Alums Acquire Seven Family-Owned Business in Seven Years in Switzerland

Creating a bootstrapped start-up may be exciting and a big draw for INSEADers with dreams of leading a high-potential company, but there is another path to becoming an entrepreneur, acquiring and developing a small or medium-sized family business. It is one path that several alums in Switzerland are taking.

Roger Kollbrunner MBA’97J, for example, has acquired four-family owned businesses since graduating from INSEAD, including a Swiss manufacturer of tractors that climb mountain tracks at speed, and most recently, a Swiss wholesaler of technical products and a leading manufacturer of industrial-sized vegetable slicers folding them into Artum AG, a holding company.

Roger is not an exception. Mark-Anthony Holloway, MBA‘98J, executed a management buy-in (MBI) of Swissfeed AG in 2008 after a one year search. Previously, he led, turned around and sold a veterinary company. More recently in 2013, Magali Larangot, MBA‘12D, acquired Soleil Vie, a brand focused on nutrition and gluten free products. Along with Swiss NAA Geneva Chapter President, Ludovic Choppin, MBA ‘12D, whom she met before INSEAD and plans to marry in June, she is now developing the Lausanne-based business.

Three others from the same class (MBA‘12D), Fabio Fagagnini, Beat Braegger, and Lukas Gayler together acquired Mikrona Technologie AG via an MBI. Operating for more than 55 years, Mikrona develops, produces and sells innovative, high-quality dentistry products. It is headquartered in Spreitenbach (Greater Zurich area), operates on a global scale and collaborates with partners in over 25 countries.

Attitude and aptitude

Fortunately for those that dream of taking this path to entrepreneurship, INSEAD alums are more than willing to share their experience. Mark-Anthony is booked to speak at a 17 March Swiss NAA event in Basel, and Roger recently spoke at a unique INSEAD Alumni event in Zurich, Salon Conversations 2014.

Fortunately for those that dream of taking this path to entrepreneurship, INSEAD alums are more than willing to share their experience. Mark-Anthony is booked to speak at a 17 March Swiss NAA event in Basel, and Roger recently spoke at a unique INSEAD Alumni event in Zurich, Salon Conversations 2014.

The first rule of thumb is, be patient. It may take at least two to three years to find the right business, according to Roger Kollbrunner. Capital is a requirement, anywhere between several hundred thousand to millions of euros.

Buying a company is not as romantic as one expects, and yet being a bit of a dreamer and optimistic is important. “Otherwise caution will prevent you from making the leap. If you look at a deal too long, for more than a year for example, you will certainly find things wrong with the business,” said Roger. Once you find a business to buy, do a proper due diligence and then close the transaction swiftly.

An adventurous attitude is required. “Be ready to jump, take the risk, and pay the price. Don’t be too stingy,” he adds. Money and time are key, but money and time are useless if the deal never closes.

Be aware that once the acquisition is complete, problems will start. “The business might need additional capital. The culture might be difficult to develop. It is normal to have these kinds of problems,” explained Roger.

Deal search and sourcing

Finding targets for a majority share acquisition is a challenge. There are M&A advisors but the disadvantage is competition. The buyer is one of many potential buyers looking at a deal. There are also private equity houses with business for sale. “My personal opinion is not to buy from private equity. They’re too well prepared for sale. It is difficult to tell as an outsider if the company has been pumped up specially for the sale or not,” said Roger.

It is possible to source without service providers. “We spend a lot of time doing research in industries we like. Anecdotally, when researching there is a rule of thumb: the worse the website, the better the business potential,” said Roger. It typically means the marketing and sales processes are not well developed yet. “Every company we bought had a bad website. But they also had strong engineering and top products,” he added.

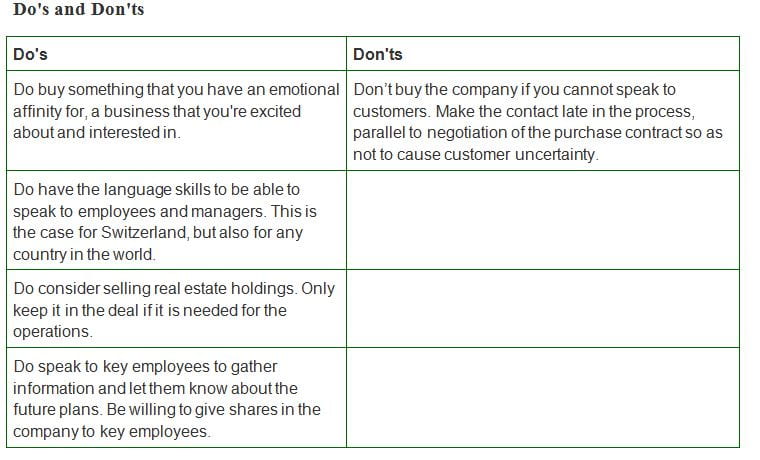

Once a company is found and it is for sale, there must be a good personal relationship with the seller. There has to be trust on both sides. There are also some key things to look for in the books. Check the quality of the revenue: is it stable or spiky. Do they have blue chip customers? What is the quality of their customer relationships? Look at the margins. Understand why sales are declining, if they are declining.

Is there real estate? Generally we try to take out before the sale any unnecessary real estate, that is, land and facilities not required for production.

In summary, buying and developing a company is a hugely rewarding job, but not without risks. “Work hard, stay alert and then the risks can usually be managed and the return can be attractive,” said Roger.

One question for Roger Kollbrunner

How did your INSEAD MBA contribute to your success?

I couldn’t have done it without the MBA. I have an engineering background [M.Sc. Mechanical engineering ETH Zurich]. What I learned at INSEAD gave me the key levers to improve the businesses and knowledge of where the risks lie. An MBA gives you the confidence because you will hit roadblocks. The Alumni network is invaluable because you can simply call colleagues who have relevant experience or the know-how required.