Jeff Bezos Photo Credit Steve Jurvetson (https://www.flickr.com/photos/44124348109@N01/5129286606) This work is licensed under a Creative Commons Attribution 2.0 Generic License (https://creativecommons.org/licenses/by/2.0/)

Bill Gates Photo Credit Simon Davis/DFID (https://www.flickr.com/photos/dfid/14590135480/) This work is licensed under a Creative Commons Attribution 2.0 Generic License (https://creativecommons.org/licenses/by/2.0/)

After dropping $13.7 billion for Whole Foods, Jeff Bezos, the third richest person in the world (100% are men in the top 10) is contemplating what to do with his $73 billion net worth. One option would be to join the likes of Buffet, Gates, Musk and Zuckerberg, and adopt The Giving Pledge. 170 billionaires have committed to give away more than half of their wealth for a variety of causes spanning poverty alleviation, refugee aid, disaster relief, global health, education, women and girls’ empowerment, medical research, arts and culture, criminal justice reform and environmental sustainability. With the Trump administration taking a hatchet to many of these causes, perhaps we need more billionaires than ever to step up. The amounts are mind-boggling as well. 5 out of the 20 richest people in the world (based on the Forbes billionaire list) are part of this pledge. Their net worth today is US$317 billion. Even if they give away only half of their net worth, that is about $159 billion, an amount not to be sniffed at. That comes to 40% of $410 billion, the entire wealth of the bottom 50%.

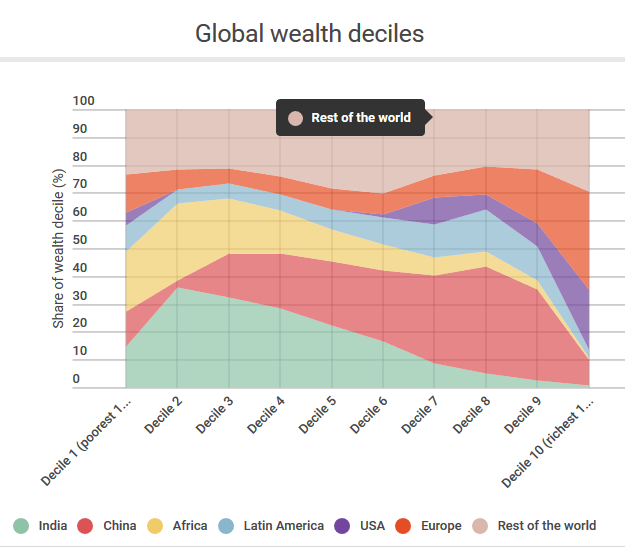

As an aside, these wealth numbers which come from Credit Suisse, and are the basis of Oxfam headlines “62/8/6 people own more wealth than the bottom 50%.” But the numbers are somewhat flawed. See if you can spot it in the graph below – it is most stark for the US. Notice how the Americans make up about 4% of the world’s poorest decile and then are absent in the next four poorest deciles. The reason this happens is that Credit Suisse looks at net worth = assets minus debts. Americans of course conform to the norm of being heavily indebted – student loans, credit card debt, high mortgages, health costs for the uninsured. So the bottom 10% has a negative net worth. This creates the absurdity that an INSEAD student from the US, with zero financial assets, a large student loan, and thus a negative net worth will be in the bottom 10% of the wealth distribution. Of course, a billion people would gladly swap places this one person. At the same time, this does not detract from the stunning levels of wealth inequality. A quick solution would be to simply drop the bottom decile in such calculations which sacrifices the click-bait nature of such headlines in favor of pedantic accuracy.

www.huffingtonpost.in

Enter Bezos

Bezos decided to take a different tack from the other billionaires. First, instead of the standard tech billionaire assumption, “I know best because I was successful selling e-books/social media platform/operating system” he decided to ask others. On Twitter. Whether the Twitter hive-mind delivers wisdom can, of course, be questioned.

Second, Bezos emphasises the short-term. Maybe because in the long-term we are all dead. This is in stark contrast to the Bill/Melinda Gates and Priscilla Chan/Mark Zuckerberg model of philanthrocapitalism that targets long-term challenges in health, environment and poverty. Gates, Zuckerberg, and even George Soros see themselves as hyperagents combining the best of philanthropy and capitalism. This is not just about check-writing. Rather, the givers/billionaires bring their time-tested capitalist principles and business skills to bear, invest their time and energy, and leverage their skills and ideas on innovation and change. Bezos’ short-term approach led to harsh push back. From Ashoka, (the social entrepreneur initiative and not the Mauryan emperor,) “This is a mistake. Addressing short-term needs, while necessary, is insufficient as it does little to change the underlying conditions that cause social problems to persist year after year, decade after decade.” The key idea is that charitable giving, while noble fails to address the true structural causes poverty and sundry social ills. It assuages the conscience of the giver while failing to have a long-term scalable and sustainable impact. In fact, initiatives such as the Gates Foundation are more about the judicious application of technocratic principles, rather than the actual monetary amounts committed. Charity may help temporarily, while philanthropy would uproot poverty itself.

An Idea for Bezos: Give The Man A Fish

This debate has a parallel in the drive to increase financial inclusion and deepen credit markets, as a poverty reduction tool. Grameen inspired microfinance initiatives have exploded worldwide and grown to a $60 billion industry, reaching 200 million borrowers. In fact, the Ashoka letter to Bezos, approvingly highlights how Muhammad Yunus’ microfinance idea “combats poverty in every corner of the globe.” Provision of financial services and access to credit unleashes the entrepreneurial potential and effectively moves people out of poverty. This is far more effective than charitable giving where cash is misused even if it reaches the target segments. Essentially, teach the woman to fish (microfinance is targeted primarily at women) and her family eats for a lifetime. Give the man a fish and you feed him, but for a day. If he does not sell said fish, and buy alcohol with the proceedings.

Unfortunately, the best possible evidence is not very inspiring in terms of the effectiveness of microfinance as a poverty alleviation tool. Six randomised studies, conducted in varying locations, failed to find statistically significant increases in household income or spending, following access to microfinance. Four of the six found no change in food consumption; one found a modest increase and the sixth found a significant decrease. The studies also did not find any evidence for women’s empowerment or for increases in school attendance. While access to microfinance did not hurt, it did not lead to a massive transformation of household life.

Some of my own work that compares micro loans by loan purpose, finds that loans given for microenterprises, do not have a superior impact compared to loans given for housing. The emphasis on funding microenterprises as a preferred way of alleviating poverty is questionable as well. The key explanation for these non-findings is that cash is fungible and borrowers don’t use the loans to start or expand businesses. Instead, they channel the money to cover basic needs, pay for emergency expenses, and/or make home repairs. Loans do help borrowers in the short term, in smoothing shocks to income, but are unlikely to transform lives.

Perhaps what Bezos should do with his many billions is simply give the cash to the needy. Unconditionally, without any constraints on how and what to spend it on. For one, it would have an immediate short-term impact – the recipients would be happier. But would such an unconditional cash transfer program (giving the man/woman the fish) be effective? Bill Gates is skeptical. According to Gates, the biggest downside of giving poor people cash handouts is that it’s fleeting. It’s not an investment that families can use to increase their income over time. He would rather give them chickens instead of fish. Not for a quick meal but as a business model. The idea is same as that of microfinance. According to Gates, within three months, five hens and one rooster can produce 40 chicks. “Eventually, with a sale price of $5 per chicken — which is typical in West Africa — [a farmer] can earn more than $1,000 a year,” escaping the $2 a day poverty trap.

But Gates may be counting chickens that are yet to hatch. Six programs have been rigorously tested that looks at the effect of giving livestock (mainly goats but some chickens as well). Three years after the program, the households receiving livestock were earning $80 more than the control group. However, the program cost $1700 per household so the initial investment takes 20 years to pay off. Hardly a stellar win for the Gates approach.

On the other hand, the evidence on unconditional cash transfers looks more and more promising. In the short-term, such transfers increased school attendance, improved health measures, and led to higher savings and investments. A new trend in the social sector is the increasing popularity of such no-strings-attached cash transfers. The new buzzword is “why not cash?” It turns out that we need to trust the poor. They have a better idea of their needs and constraints.

So at least for short-term effectiveness, Bezos should simply give his money away. But what of the long-term? To examine the long-term impact of such cash transfer, the charity GiveDirectly has begun a rigorously designed 12-year basic-income study in Kenya. The study uses M-Pesa, the mobile money system in Kenya, to deposit 2,280 Kenyan shillings (about $22) a month for the next 12 years as basic income. It then tracks these households on a variety of decisions and outcomes. If such an intervention is successful, then any philanthropic activity must be judged on whether it can do better than simply directing money into the hands of the poor. Only time will tell if this is a simple and scalable alternative. If it is, just give the man a fish.